First Time Buyers Government Assistance

It is an exciting time when you have reached that stage in your life where you are ready to buy your first home. Sure it is a big step, but don’t be afraid! With proper research and some help along the way, this first home can turn into a worthwhile investment.

The government provides various benefits to first time homebuyers in Canada, which any first time buyers should make themselves aware of. First Time Buyers Government Assistance is a great perk. Here are a few key benefits first time buyers should become acquainted with.

1) Home Buyer’s Plan (HBP)

The federal government of Canada provides you the opportunity to withdraw $25,000 from your RRSP tax-‐free to help fund your down payment. Not only are you depositing money into your RRSP tax free, but also as a first time homebuyer you are able to withdraw it tax-‐free to help you fund your purchase. If both you and your spouse qualify, you can each withdraw $25,000 towards your down payment for a total of $50,000.

Conditions in order to be eligible:

- You or your spouse must not have owned or partially owned a property in the last 5 years

- The money must have been in your RRSP for at least 90 days

- Repaying RRSP – you must pay back the $25,000 borrowed from you RRSP over the next 15years ($1,667 per year)With this in mind, it is never too early to set up an RRSP account and benefit from the Home Buyer’s Plan (HBP) down the road.

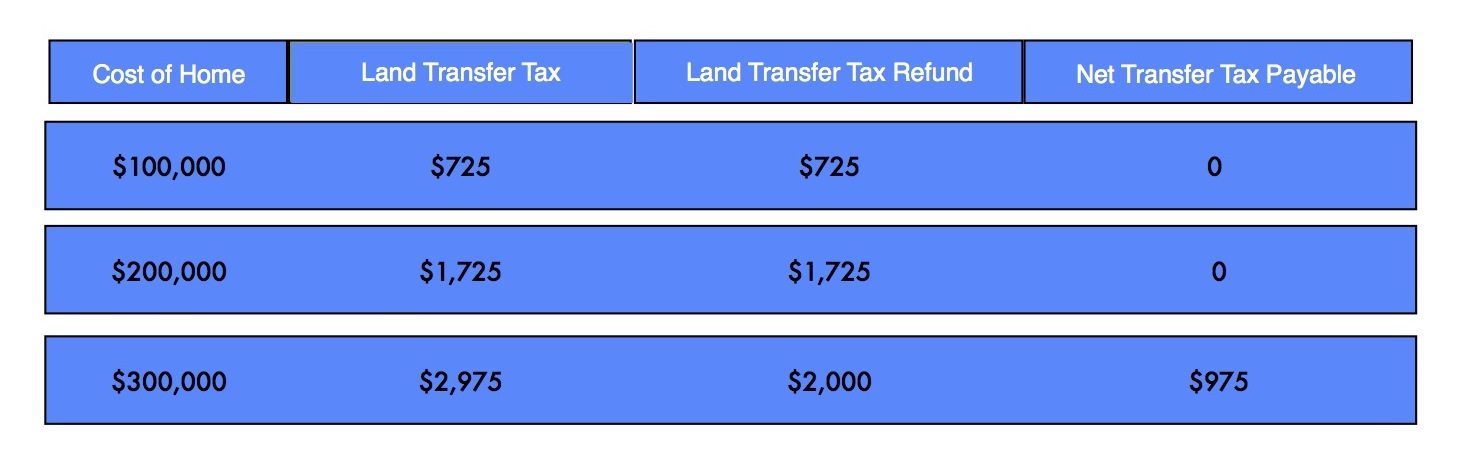

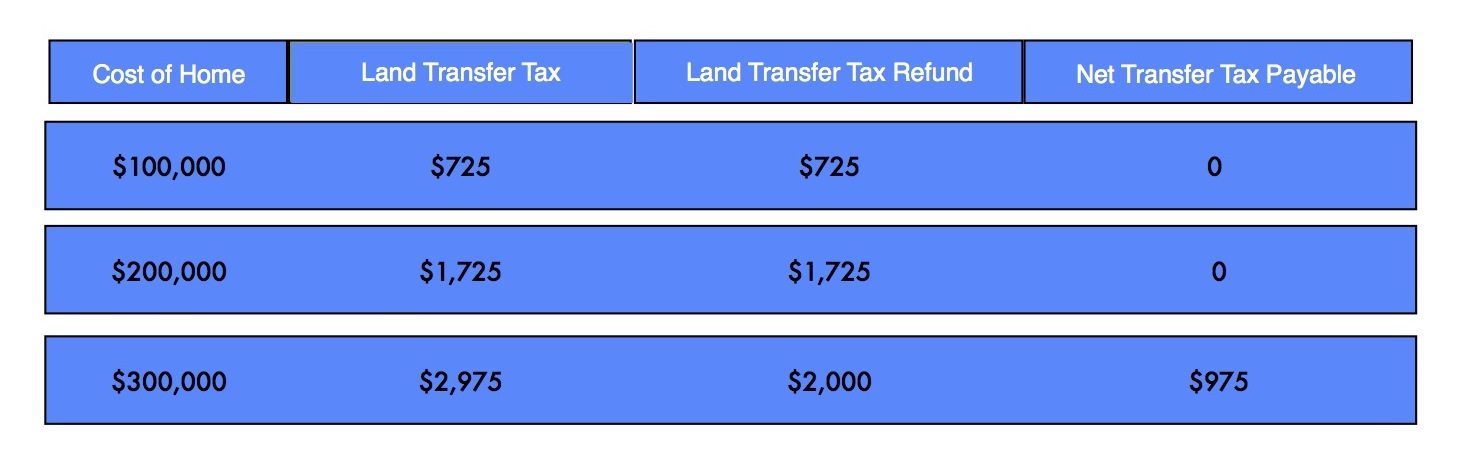

2.) Transfer Tax Refund

The Ontario government provides first time homebuyers with a refund up to $2,000 on their land transfer taxes when purchasing a home.

Example:

Conditions in order to be eligible:

- You must not have owned or owned an interest in a home anywhere in the world

- Your spouse must not have owned any interest in a home while he/she was your spouse

- You must apply for it no later than 18 months after the registration date. For more details

3) First Time Home Buyers’ Tax Credit (HBTC)

The HBTC is a new non-‐refundable tax credit since 2009 and subsequent years. You OR your spouse can include this tax credit on your annual income tax return. The credit is based on the amount of 5,000 (as of 2012) where one can claim a maximum credit of $750 (5000 x 15%).

Conditions in order to be eligible:

- You or your spouse must have acquired a qualified home purchased after January 27, 2009

- You or your spouse must not have owned or partially owned a property in the last 4 years.

First time buyers government assistance is a great way for you to have a bit more towards buying that first home. You’re only a first time buyer once so take advantage of these great incentives while they are available to you.

Looking for more info?

Get in touch and find out how we can help.

COMMENTS